Tax Free Bonds 2025. So far this filing season, 943,000 filers have taken. Wed 6 mar 2025 11.39 est first published on wed 6 mar 2025 10.18 est.

However, around 40% of sovereign bonds and 37% of corporate bonds globally will mature by 2026, requiring further borrowing from the markets under higher interest. During the 2025 tax filing season, taxpayers have the option of purchasing united states savings bonds, series i, providing the opportunity to use a portion of your tax refund to.

However, around 40% of sovereign bonds and 37% of corporate bonds globally will mature by 2026, requiring further borrowing from the markets under higher interest.

Tax Free Bonds Meaning, how to buy and more details, 2.these are issued by government entities like companies, municipal. So far this filing season, 943,000 filers have taken.

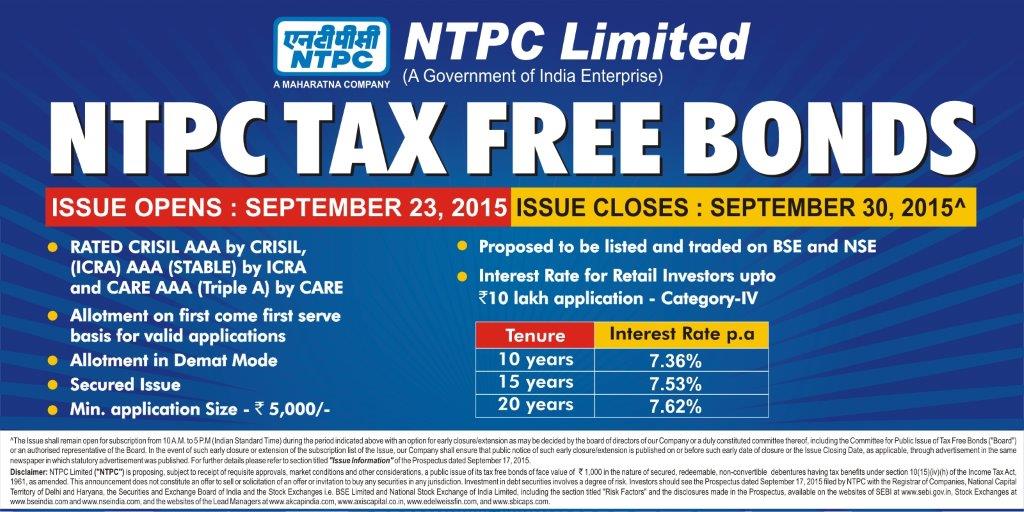

Tax Free Bonds NTPC 2025 2025 Student Forum, For married people filing jointly, it rose to $27,700, up $1,800; 22, 2025 — irs free file is now available for the 2025 filing season.

TaxFree Bonds What You Need to Know Before Investing Guest Posting, We remain optimistic about muni bonds going into 2025 and believe that there are opportunities to find value across the credit spectrum. Wed 6 mar 2025 11.39 est first published on wed 6 mar 2025 10.18 est.

Exploring TaxFree Bonds Your Guide to TaxEfficient Investing, Below is a comparison to the cut in class 4 nic’s from 9% down to 6% which takes effect from 6 april 2025 for profits between £12,570 and £50,270 will drop from 9%. There's been quite a shift in investor sentiment from early november, when only 24.3% had a bullish outlook on equities and 50.3% were.

Tax Free Bonds Meaning, How to Invest? Kuvera, With this program, eligible taxpayers can prepare and file their federal tax returns using. The 5 best bond funds for 2025.

TAXFREE BONDS EXPLAINED! HOW TO BUY TAXFREE BONDS? YouTube, Income from a municipal bond, or muni, is usually exempt from regular federal income tax (but may be. Investors favor municipal bonds, or munis, for two main reasons.

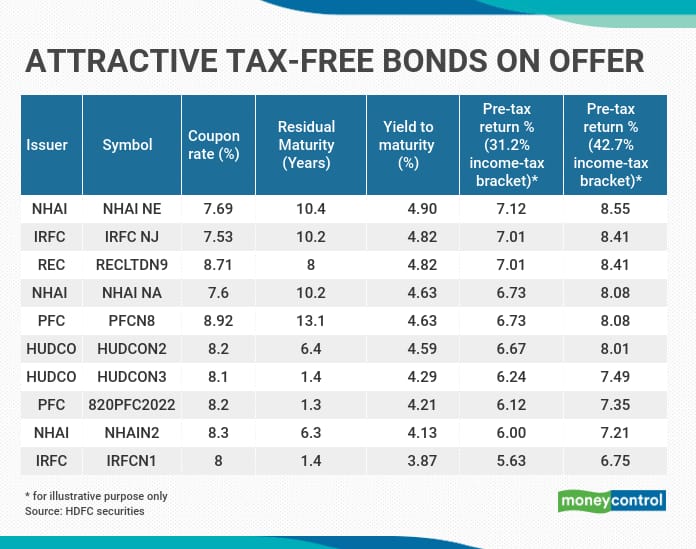

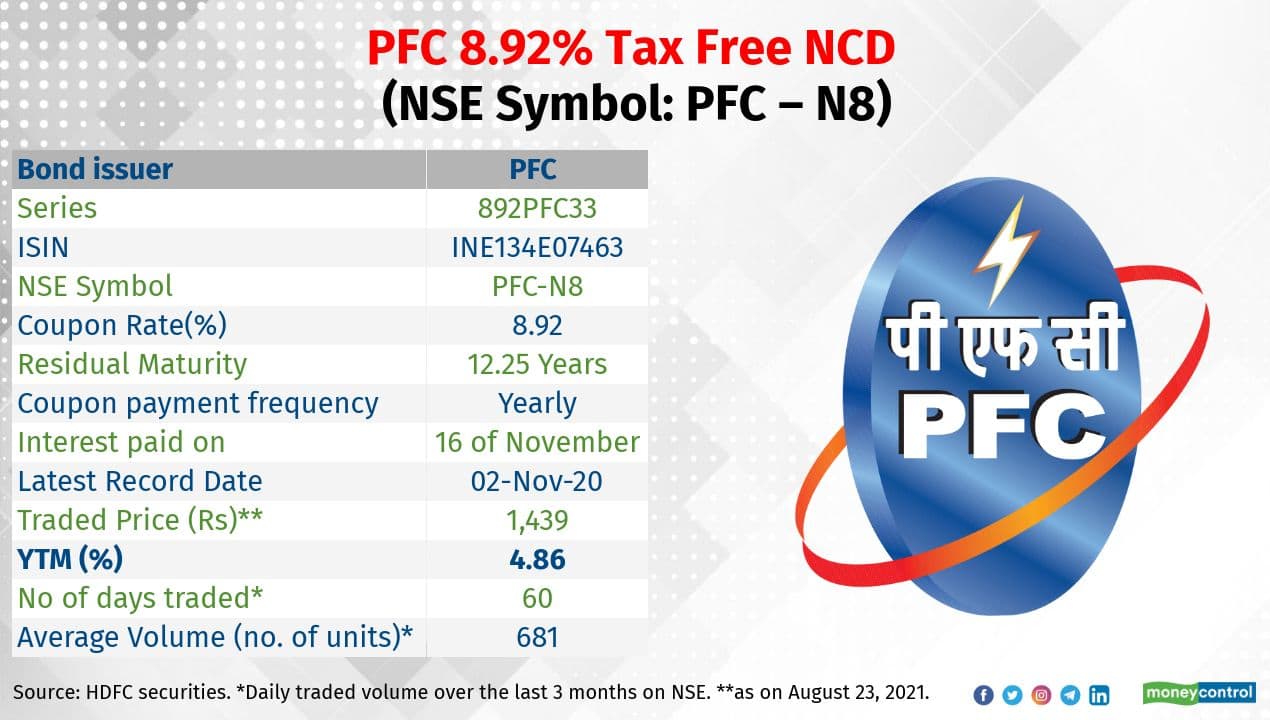

Six tax free bonds that bring safety and returns Six tax free bonds, Treasury bond is free from state and local taxes. Below is a comparison to the cut in class 4 nic’s from 9% down to 6% which takes effect from 6 april 2025 for profits between £12,570 and £50,270 will drop from 9%.

Tax Free Bonds What You Need to Know Before Investing, During the 2025 tax filing season, taxpayers have the option of purchasing united states savings bonds, series i, providing the opportunity to use a portion of your tax refund to. For married people filing jointly, it rose to $27,700, up $1,800;

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, 22, 2025 — irs free file is now available for the 2025 filing season. Through the end of april 2025, i bonds were offering an interest rate of 5.27% (1.3% fixed and 3.97% variable).

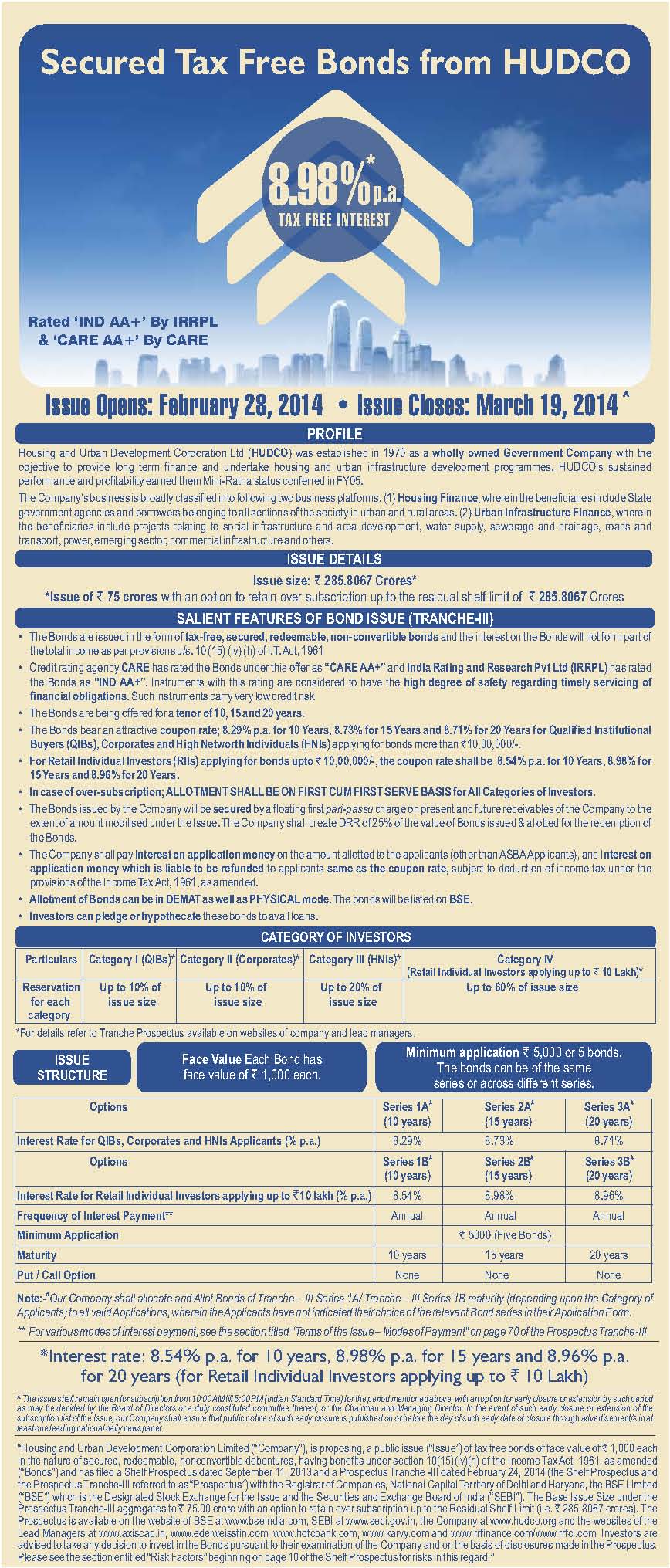

HUDCO Tax Free Secured Bonds 2025 2025 Student Forum, During the 2025 tax filing season, taxpayers have the option of purchasing united states savings bonds, series i, providing the opportunity to use a portion of your tax refund to. 22, 2025 — irs free file is now available for the 2025 filing season.

However, around 40% of sovereign bonds and 37% of corporate bonds globally will mature by 2026, requiring further borrowing from the markets under higher interest.

Through the end of april 2025, i bonds were offering an interest rate of 5.27% (1.3% fixed and 3.97% variable).